Insolvency Worksheet Canceled Debts free printable template

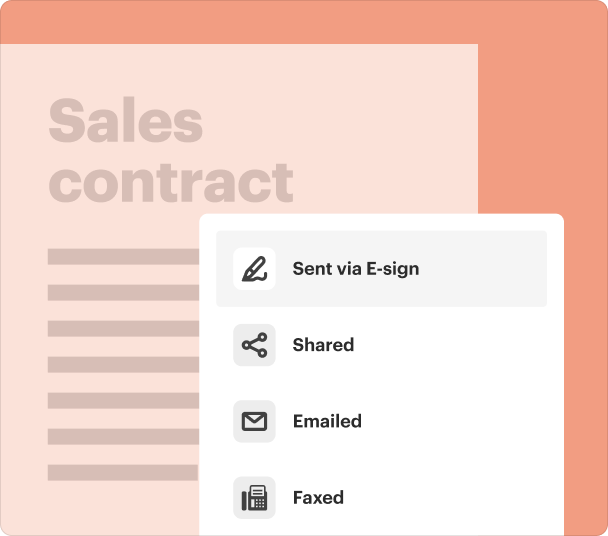

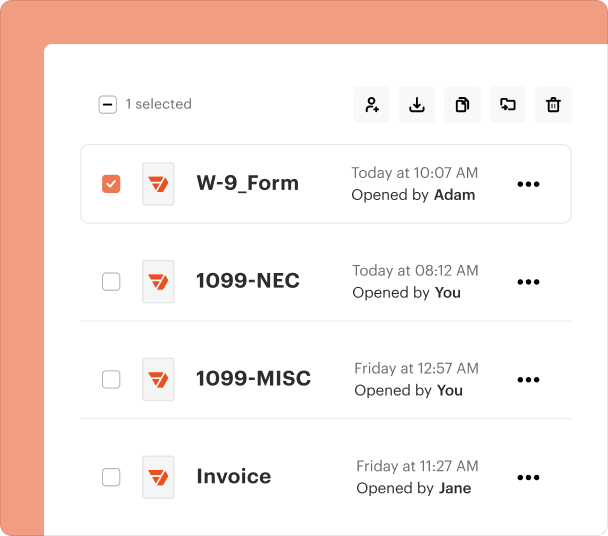

Fill out, sign, and share forms from a single PDF platform

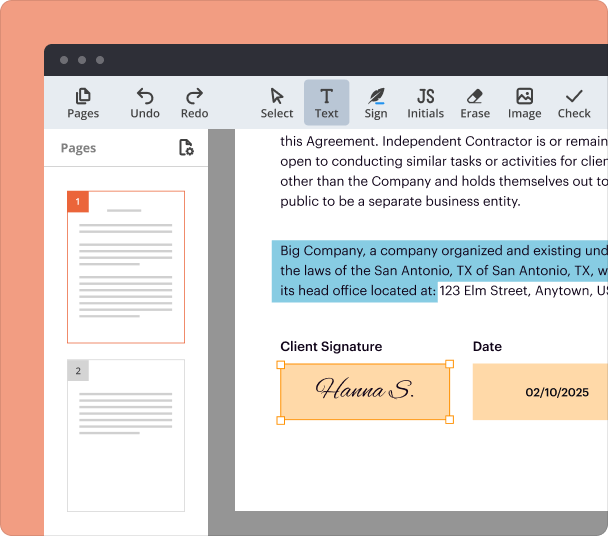

Edit and sign in one place

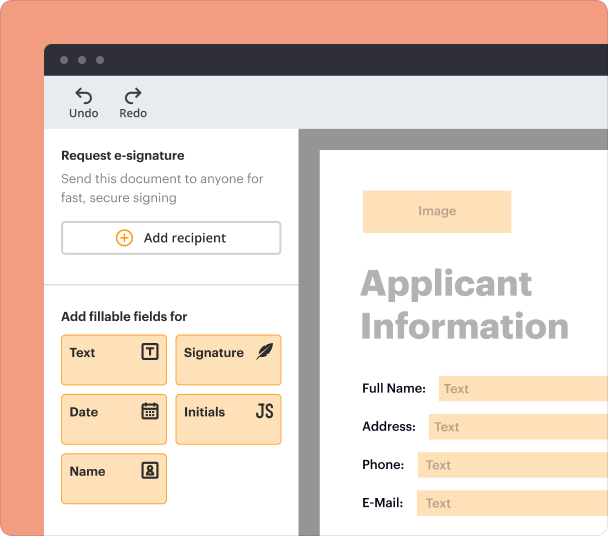

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Insolvency Worksheet for Canceled Debts: A Comprehensive Guide

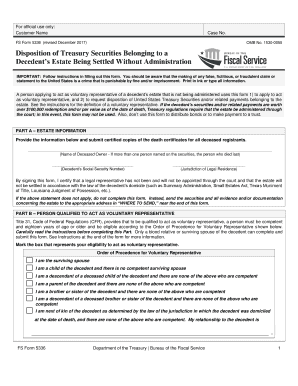

Filling out an insolvency worksheet for canceled debts is crucial to effectively manage your financial obligations. This guide will walk you through using the insolvency worksheet to document and report your canceled debts, ensuring compliance with IRS guidelines.

What is insolvency and why is it important in relation to canceled debts?

Insolvency is defined as the inability to pay one’s debts as they come due. This condition is relevant for tax purposes because canceled debts can impact your gross income. Understanding the IRS guidelines surrounding cancellation of debt is essential for effective financial planning.

-

The inability to meet financial obligations when they are due.

-

Understanding how canceled debts influence your tax liability is critical.

-

Familiarity with IRS rules regarding debt cancellation can save you from potential tax complications.

What is included in an insolvency worksheet?

An insolvency worksheet is a critical document that helps in accurately documenting canceled debts. Its primary purpose is to capture all relevant financial information, which can then be used to determine your tax obligations. Using tools such as pdfFiller can significantly enhance how you prepare this document.

-

Record the date when debts were canceled to maintain chronological accuracy.

-

Summarize all debts before cancellation, providing a clear picture of your financial situation.

-

Include an assessment of all assets to establish their worth at the time of debt cancellation.

Why is it essential to document total liabilities before cancellation?

Accurate documentation of liabilities before cancellation is paramount to maintain financial transparency and integrity. It helps distinguish between different types of debt such as credit card debt and loans. Using an interactive tool, like pdfFiller, allows users to easily track and edit these financial obligations.

-

Documenting debts helps in assessing your overall financial condition.

-

Understanding whether debts are secured or unsecured assists in efficient management.

How to assess the fair market value of your assets?

Calculating the fair market value (FMV) of assets plays a crucial role when filling out the insolvency worksheet. It must include all relevant assets, such as cash, real estate, and investments. pdfFiller can help in managing and organizing this inventory easily.

-

Evaluate all forms of assets including cash, vehicles, and real estate to determine their FMV.

-

Depending on the asset, use market comparisons or professional appraisals to establish accurate values.

What are the tax implications of canceled debt?

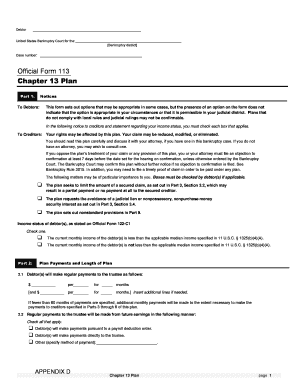

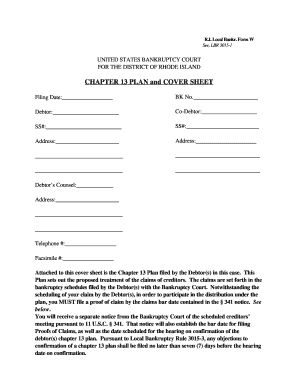

Understanding the tax implications arising from canceled debts is crucial for taxpayers. IRS Form 1099-C is issued for most canceled debts, and it is vital to report these correctly on your tax return. Knowing how to navigate these tax implications can help avoid common pitfalls.

-

This form reports the amount of canceled debt that may be taxable for federal income tax purposes.

-

Some taxpayers overlook their exclusion options, leading to incorrect tax filings.

What types of examples illustrate insolvency situations?

Real-life scenarios of insolvency can greatly illuminate the impact of canceled debts. Cases involving foreclosures and repossessions serve as crucial learning tools. Utilizing interactive case studies available on pdfFiller can further enhance understanding.

-

Situations where individuals lose their property due to unpaid mortgage obligations.

-

When lenders take back property due to unpaid debts, showcasing the need for proper documentation.

What are common mistakes made when handling canceled debt?

Various frequent errors can occur when documenting insolvency and canceled debts. Ensuring accuracy and compliance in your insolvency worksheet can prevent penalties. Tools like pdfFiller provide verification features to enhance compliance.

-

Not including all debts can result in inaccurate financial reports.

-

Incorrect fair market valuations could mislead financial assessments.

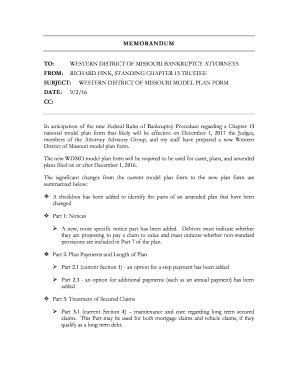

When should you seek professional tax help?

Certain indicators suggest when professional assistance is necessary in complex insolvency situations. Resources available through pdfFiller can connect you with qualified tax professionals who can offer guidance. Seeking expert advice can greatly enhance the management of intricate financial matters.

-

When debts become unmanageable, consulting with a professional can provide new strategies.

-

Professional support is beneficial for navigating intricate tax laws regarding insolvency.

Frequently Asked Questions about insolvency worksheet form

How do I report canceled debt on my tax return?

To report canceled debt, include the amount indicated on IRS Form 1099-C on your tax return. This amount may increase your taxable income, unless you qualify for exclusions.

What types of debts can be excluded from taxable income?

Certain debts, such as qualified principal residence indebtedness or debts discharged in bankruptcy, may be excluded. It's essential to review IRS guidelines for specific exclusions related to your situation.

What is the insolvency exclusion and who qualifies?

The insolvency exclusion allows taxpayers who are insolvent at the time of debt cancellation to exclude some or all of the canceled debt from taxable income. This generally applies if liabilities exceed the fair market value of assets.

Can I file my insolvency worksheet online?

Yes, you can fill out and manage your insolvency worksheet online using tools like pdfFiller, which offer user-friendly features for editing and saving documents securely.

What happens if I make mistakes on my insolvency worksheet?

Mistakes on your insolvency worksheet can lead to issues during tax filing, including potential audits or penalties. It’s important to double-check all information and consult professionals if necessary.

pdfFiller scores top ratings on review platforms