Insolvency Worksheet Canceled Debts free printable template

Show details

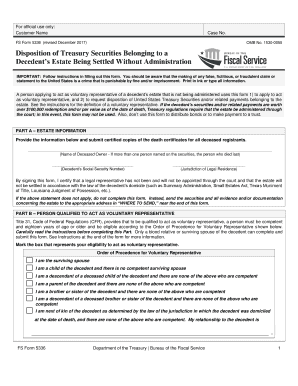

Insolvency WorksheetKeep for Your RecordsDate debt was canceled (mm/dd/by)

Part I. Total liabilities immediately before the cancellation (do not include the same liability in more than one category)

Amount

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign insolvency worksheet form

Edit your fillable insolvency irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fillable insolvency irs pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insolvency worksheet cancellation of debt online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs insolvency worksheet pdf form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs insolvency worksheet form

How to fill out Insolvency Worksheet Canceled Debts

01

Gather all relevant financial documents, including records of canceled debts.

02

Identify the debts that have been canceled or forgiven.

03

Determine the amount of each canceled debt.

04

Fill in the worksheet with the total amount of canceled debts in the designated section.

05

Provide details of the creditor for each canceled debt, including name and contact information.

06

Indicate the date each debt was canceled.

07

Review all entries for accuracy before submission.

Who needs Insolvency Worksheet Canceled Debts?

01

Individuals who have had debts forgiven or canceled, such as through a settlement or bankruptcy.

02

Taxpayers seeking to report canceled debts on their tax returns.

03

Those who need to demonstrate financial hardship or insolvency for legal or financial reasons.

Fill

insolvency worksheet spreadsheet

: Try Risk Free

People Also Ask about insolvency worksheet irs

What happens when a debt is Cancelled?

Debt cancellation occurs when a creditor discharges a debt, releasing a borrower from the obligation to repay it. Unless debt cancellation comes in the form of bankruptcy or debt settlement, cancellation of debt doesn't always impact your credit score. However, debt cancellation may not be all good news for you.

How do I prove insolvency to the IRS?

If you are insolvent you need to explain this to the IRS in one of two ways. By filing IRS Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness, or. Attaching a detailed letter to your tax return explaining the calculation of your total debts and assets.

What do you need to prove insolvency?

A taxpayer is insolvent when his or her total liabilities exceed his or her total assets.

What is the insolvency exclusion for debt cancellation?

Insolvency exclusion Discharged debt is excluded from gross income if the discharge occurs when the taxpayer is insolvent. For purposes of the exclusion, insolvency is defined as the amount in which the taxpayer's liabilities exceed the taxpayer's assets.

How do I claim insolvency for credit card debt?

To claim insolvency, you'll need to fill out IRS Forms 1099-C and 982. These forms should be filed with your federal income tax return for any year in which a discharge of indebtedness was excluded from your income. Form 1099-C reports cancellation of debt (greater than $600) to the IRS.

How do I not pay tax on cancellation of debt?

If you can demonstrate to the IRS that you were insolvent at the time the debt was cancelled, you can similarly avoid taxes on that debt. Certain other types of debt, including qualified farm indebtedness and qualified real property business indebtedness, can also avoid taxation in the event of cancellation.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify insolvent spreadsheet liabilities without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like cancellation of debt insolvency worksheet, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete insolvency worksheet values online?

With pdfFiller, you may easily complete and sign insolvency worksheet fill form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in statement of insolvency worksheet without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing insolvency worksheet calculating and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is Insolvency Worksheet Canceled Debts?

Insolvency Worksheet Canceled Debts is a form used to report the cancellation of debts when a taxpayer is insolvent, which generally means their liabilities exceed their assets. This worksheet helps determine how much canceled debt can be excluded from income.

Who is required to file Insolvency Worksheet Canceled Debts?

Taxpayers who have had debts canceled and are claiming insolvency as a reason to exclude the canceled debt from their taxable income are required to file the Insolvency Worksheet Canceled Debts.

How to fill out Insolvency Worksheet Canceled Debts?

To fill out the Insolvency Worksheet Canceled Debts, taxpayers need to list all their assets and liabilities to determine their net worth. They must provide detailed information about the canceled debts and ensure to complete any calculations to show insolvency.

What is the purpose of Insolvency Worksheet Canceled Debts?

The purpose of the Insolvency Worksheet Canceled Debts is to help taxpayers accurately report canceled debts and claim the necessary exclusions from taxable income, thereby preventing potential tax implications from forgiven debts.

What information must be reported on Insolvency Worksheet Canceled Debts?

The information that must be reported on the Insolvency Worksheet Canceled Debts includes a complete list of assets and liabilities, the details of the canceled debts, and calculations that demonstrate the taxpayer's insolvency status.

Fill out your Insolvency Worksheet Canceled Debts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insolvency Worksheets Individuals is not the form you're looking for?Search for another form here.

Keywords relevant to insolvency worksheet debts printable

Related to insolvency worksheet useful

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.